ri tax rate on unemployment benefits

Today the Department of Labor and Training announced new maximum weekly benefit amounts for the two major income support programs it runs for Rhode Island workers and employers Unemployment Insurance UI and Temporary Disability Insurance TDI. If your small business has employees working in Rhode Island youll need to pay Rhode Island unemployment insurance UI tax.

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

The 2021 TDI Contribution Rate was 13 percent.

. UI tax rates are calculated using a. In Rhode Island state UI tax is just one of several taxes that. Guidance on Rhode Island tax treatment of unemployment benefits.

Division reminds taxpayers and tax preparers about existing Rhode Island statute. The TI TDI rate has been adjusted to 11 for all employees. This is an increase of 7500 101 from the 2021 taxable wage base of 74000.

Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. However the State of Rhode Island will use the same tax rate schedule for 2019 that it used for 2018 -- Schedule G. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line.

The TDI wage base increased from 74000 to 81500. The TDI Taxable Wage Base for Rhode Island employees will be 81500 in 2022. Rhode Island unemployment insurance UI tax at a glance 2020 2021 Taxable wage base 24000 24600 Tax rate schedule F H Tax rate range 069 to 919 099 to 959 Tax rate ranges do not include the 021 assessment for the Job Development Fund which is the same for 2021 as it was for 2020.

7031 Koll Center Pkwy Pleasanton CA 94566. The UI tax funds unemployment compensation programs for eligible employees. Your weekly benefit rate will be equal to 385 of the average of the total wages in the two highest quarters of the base period not to exceed the defined maximum amount.

The U-3 rate is the rate closest to the standard definition of unemployment - individuals in the labor force without a job who are available for and actively seeking work - Rhode Islands annual average unemployment rate for 2021 obtained directly from the CPS survey was 55 percent. The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. If you receive Form 1099-G from the Rhode Island Department of Labor and Training for unemployment benefits you did not file for or receive please report it at the button below.

The Rhode Island UI tax rate schedule known as the experience rate table Schedules A I under Rhode Island General Laws 28438 is determined based on the amount. Unemployment insurance payments are taxable income. Effective 1222 the minimum is 62 and maximum is 661 not including dependency allowance.

For all unemployment claimants that received benefits in 2021 the 1099-G form is now available to download here. Reminder about taxes on unemployment benefits. Rhode Island Unemployment Insurance Account Number and Tax Rate.

Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. 29 rows The employer tax rates in these schedules include a 021 Job Development. UI tax rate schedule that applies to all employers could change for 2021.

The UI taxable wage base is set at 465 percent of the average annual wage of workers at taxable employers. Rhode Island Division of Taxation. The rate for new employers will be 116 percent including the 021 percent Job Development Assessment.

For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

For Employers at the highest tax rate26100. It is a tax form that provides information on benefits paid in 2020. For most Rhode Island employers the taxable wage base for calculating the Rhode Island unemployment insurance UI tax will be 23600 for 2019 compared with 23000 for 2018 an increase of 600 or 261 percent.

One Capitol Hill Providence RI 02908. Your weekly benefit rate remains the same throughout your benefit year. If you receive a letter from the IRS or Form 1099-G from the Rhode Island Department of Labor and Training regarding.

Is it possible that the 2021 Tax Rate Schedule will be adjusted as a result of the number of. Beginning July 1 2020 the maximum weekly benefit rate for Unemployment Insurance will increase to. Subscribe for tax news.

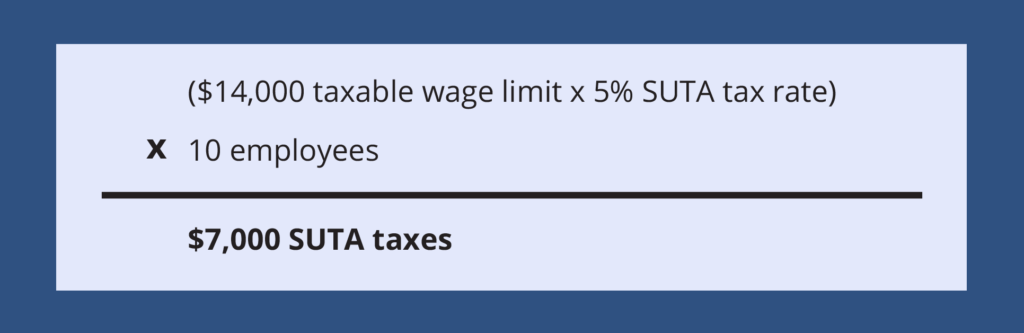

This is what a 1099-G looks like. The Unemployment Insurance wage base increased from 27300 to 27700. 52 rows You may receive an updated SUTA tax rate within one year or a few.

Which reimbursable employers are required to reimburse states for benefits paid to their workers who claim unemployment insurance by 50 percent through December 31 2020. TAX RATES120 to 980 Deducted from. DEPARTMENT OF LABOR AND TRAINING 2021 UI AND TDI QUICK REFERENCE Effective July 1 2021 UNEMPLOYMENT TDI TCI INSURANCE INSURANCE TAXABLE WAGE BASE 24600 74000.

Directions Google Maps. For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher. For additional information on Rhode Island Unemployment taxes visit the Rhode Island Division of Taxation landing page.

This will also be mailed to claimants. If you already have a Rhode Island Withholding Account Number you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829. The Rhode Island Division of Taxation today provided guidance explaining that Rhode Islanders will be able to deduct up to 10200 of unemployment compensation on their federal personal income tax.

2022 Tax Rate 11 percent 0011 The Temporary Disability Insurance contribution rate will be 11 percent for calendar year 2022.

How To Claim Unemployment Benefits H R Block

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

Jobless Claims Were Worse Than Expected Amid Slowdown In Hiring Unemployment New Tricks Financial News

How Unemployment Benefits Are Calculated By State Bench Accounting

Is The Extra 600 Unemployment Check Weekly Your Money Questions Answered

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

:max_bytes(150000):strip_icc()/dotdash_Final_Okuns_Law_Economic_Growth_and_Unemployment_Oct_2020-01-2e5dd7aa7c194e14a82707b84b00d1a3.jpg)

Okun S Law Economic Growth And Unemployment

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

Unemployment Benefits For The Jobless

1099 G Unemployment Compensation 1099g

Ri Promise More Info On Unemployment Fraud

Numerous States Announce 2022 Unemployment Tax Increases 501 C Services

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022 Providence Business News

Pin On Employee Or Independent Contractor

Ri Promise More Info On Unemployment Fraud

1099 G Tax Information Ri Department Of Labor Training

What S The Cost Of Unemployment Insurance To The Employer

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth