newport news property tax exemption

Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. Surviving spouses of veterans who meet the criteria.

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

APPLICATION for SENIOR PROPERTY TAX EXEMPTION CLAIM.

. When an automobile is licensed with out-of-state tags solely in the military members name a Newport News personal property return is not required. Click here to contact the Tax Assessors Office. Newport news va 23607 main office.

Certain types of Tax Records are available to the general. Cold War Veterans Now Qualify for Tax Exemption. However after the proposal received pushback from then-Councilor Jeanne Marie Napolitano and Councilor Kathryn Leonard then-Mayor Bova moved to table the.

Residents of the City of Newport age 65 and older who have lived in their homes for a minimum of five 5 years with income levels at or below. The City of Newport News Treasurers Office makes every effort to produce and publish the most current and accurate property tax information possible. Newport News VA 23607 Main Office.

Appeal Rules for Real Estate-Tangibles. Newport news has 8 rebates and tax credits that you may be eligable for. Refer to Car Tax Relief qualifications.

The real estate tax exemption program and the solid waste fee grant program have different income guidelines. Learn all about Newport News County real estate tax. The Newport News County Revenue Commission located in Newport News Virginia determines the value of all taxable property in Newport News VA.

Surviving Spouses of Armed Forces Members Killed in Action. Application window is August 5th through November 3rd. At this stage property owners usually order service of one of the best property tax attorneys in Newport News VA.

Skip to Main Content. 2022 Senior Citizen Exemption Form. Veterans who are 100 permanently or totally disabled with proof from the US.

If you are in the Armed Services not a resident of Virginia and are a full time active duty military member you may be exempt from the personal property tax and vehicle license fee based on your military status. The value of the tax exemption equals the cost or a percentage of the cost of equipment and system. 757-247-2628 Department Contact Business License.

Learn how we calculate your vehicles discount for your personal property tax. Determine what your real real estate tax bill will be with the higher value and any exemptions you are allowed. The Newport News City Council voted to switch from a tax exemption program to a deferral last year which means that instead of being exempt from property taxes lower-income seniors can now defer.

Find information about tax relief deferral exemption and abatement. Individuals who meet certain conditions including age income and assets may qualify for a property tax deferral or exemption. This provision passed by the General Assembly earlier this year also includes the widowwidower of a veteran who served during the Cold War.

Newport News Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Newport News Virginia. Then question if the size of the increase is worth the work it will take to appeal the assessment. The General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US.

Principal residents of the property. Department of Veterans Affairs or its successor agency pursuant to. Bova presented a similar resolution to the City Council in 2020 that would have asked for permission from the General Assembly to create a split-tax system in lieu of a homestead exemption.

Personal Property Tax Relief Act The tax on the first 20000 of the assessed value of your qualified personal property will be reduced for tax years 2006 and forward. It is my opinion that the exemption from or deferral of real property taxes authorized in Article X 6b for persons not less than 65 years of age or disabled does not extend to a person who has placed title to the real property in any form of trust but does extend to a person who otherwise qualifies for the exemption and who holds a life estate in the real. Click here to download an application.

Newport news va 23607 main office. Application window is January 1st through March 15th. The Newport News Office of the Commissioner of Revenue is accepting applications for the Seniors and Disabled Property Tax Relief Program available to Newport News property owners.

Department of Veterans Affairs to have a 100 service-connected permanent and total disability and who occupies the real property as his or her principal place of residence. For properties considered the primary residence of the taxpayer a homestead exemption may exist. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Solar Energy Equipment Tax Exemption Residential and commercial property owners who have installed solar equipment used for heating purposes or other applications that would normally need a conventional energy source qualify for this type of property tax exemption. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Department of Veterans Affairs.

Property assessments performed by the. 2021-22 Tax Appeal Form for Motor Vehicles. Loading Do Not Show Again Close.

2022 Annual Return to the Assessor. Disabled Veterans Property Tax Exemption. These records can include Newport News property tax assessments and assessment challenges appraisals and income taxes.

This form must be received in the Tax Assessors office by March 15 2018 to qualify. 2021-22 Tax Appeal Form for Real Estate and Tangible Personal Property. For qualifying vehicles valued at 1000 or less your obligation to pay this tax has been eliminated for tax years 2006 and forward.

NEWPORT City homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption. Newport homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption. The Newport News City Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes.

Note- City code requires that all Deferred tax years andor the current fiscal year of Elderly Tax Exemption be reinstated if the property is being sold or there is a change in ownership.

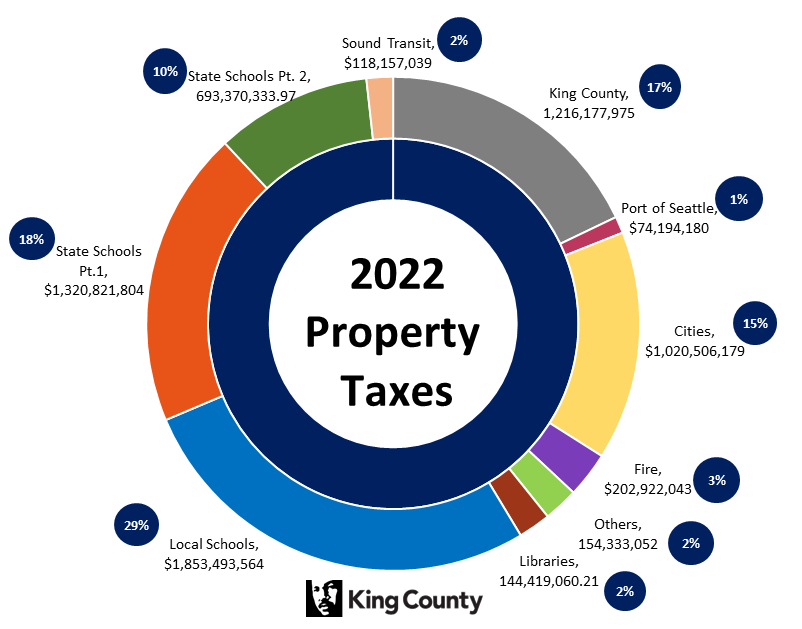

The Ultimate Guide To North Carolina Property Taxes

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Silverlining On Tragedy If Your Houston Apartment Complex Survived It Will Probably Soon Be Full Realestatecrowdfun Houston Apartment Apartment Real Estate

Personal Property Tax Portsmouth Va

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Silverlining On Tragedy If Your Houston Apartment Complex Survived It Will Probably Soon Be Full Realestatecrowdfun Houston Apartment Apartment Real Estate

Real Estate Tax Exemption Virginia Department Of Veterans Services

Property Tax Relief For Homeowners Disability Rights North Carolina

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

High Mileage Relief Newport News Va Official Website

Sag Harbor Village Cinema Sag Harbor Sag Harbor New York Harbor

Commissioner Of The Revenue Newport News Va Official Website

Foreigner Buying Property In Pakistan In 2022 Ocean View Apartment Buying Property Different Types Of Houses

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Virginia Wineries Wineries Near Quantico Fredericksburg Dc Virginia Wineries Virginia Is For Lovers Quantico